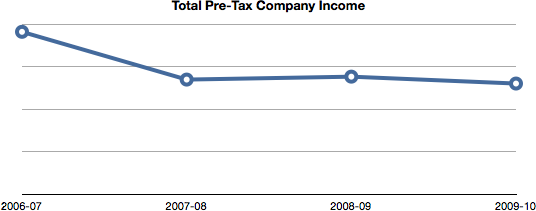

I've haven't been shy about sharing my personal financial difficulties on this blog. However, one thing I was worried about was that my financial troubles were being caused by fundamental cracks in the foundations of my company. The year's accounts have just been completed, and I'm very relieved to find out that isn't the case. Allow me to present a graph to demonstrate.

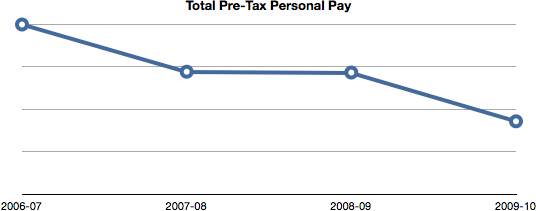

2006-7 was a bumper year, but other than that, it's all nice and flat. Phew! However, let's take a look at my pay (not on the same scale as the above graph):

Well, that'd explain that, then. The increased pressure on the company caused by the failure of the GeoCachr project means there's less spare money to pay me with. I choose that wording carefully — as my bank manager once very succinctly put it, I get paid last. This company has obligations to its customers, HMRC, its creditors and staff. If there's any money left over for me, hooray! — I get paid. If not, well, sucks to be me. The fact my pay is more than zero means the company has spare cash, and that's a good thing. The fact that the company's income has been stable for three consecutive years is also a good thing.

Detail

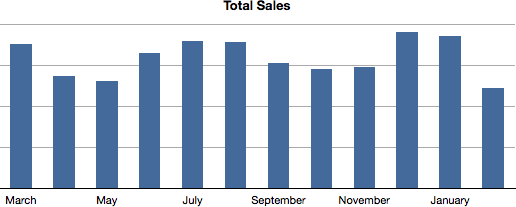

So, let's have a look at my company's cashflow in a bit more detail. First, month to month, bearing in mind my company year runs March-Feb:

Not much to report here. As normal, my best months were December and January. As normal, my worst month was February. Next!

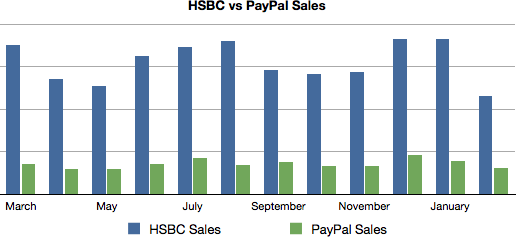

I find this graph very interesting. At the top of the payment details page on my store, it says:

Please enter your card details below, or click here to pay with PayPal.

When the user clicks to pay with PayPal, the card number fields disappear and the payment will be done with PayPal instead of my card provider, HSBC. Over the whole year, only 18.7% of my income was done through PayPal. PayPal's reason for existing is to provide customers with a "trusted" company to place payments through. If you take this data at face value (which would be stupid, I'll admit), it would suggest that over 80% of my customers would rather type their credit card details into my site and trust me than trust PayPal.

Now, I dislike PayPal. They're more expensive than HSBC for processing payments, and they do a bunch of stupid stuff all the time. I don't trust them, and never keep more than a few hundred pounds in my account at any one time. This data may suggest that I'm not alone in disliking PayPal. However, I'm not going to remove PayPal from my site — 19% of my income was through them, which isn't an insignificant number.